By Pat Grubb

Whatcom County Assessor Keith Willnauer was bang on when he recently advised that county taxpayers could expect a hefty increase in this year’s property taxes. The bad news is written all over the 2018 tax rates that have been sent to the county treasurer’s office to use in issuing individual tax bills.

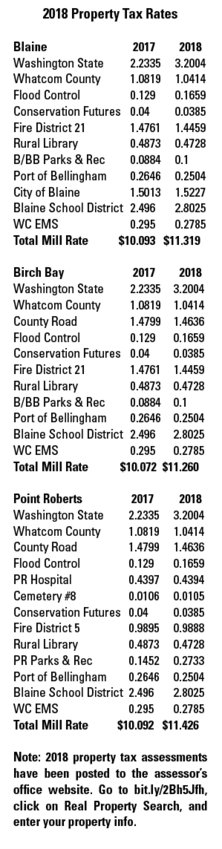

Property owners in Birch Bay, Blaine and Point Roberts can expect percentage increases of 11.8, 12 and 13, respectively, in their property tax bills. For example, the average house value of $276,900 in Birch Bay would see property taxes of $3,118 in 2018, up $329 from 2017. The mill rate (tax per $1,000 valuation) has increased from $10.07 to $11.26.

In Blaine, the average house value of $264,800 would generate property taxes of $2,997 in 2018, versus $2,672 in 2017. The mill rate is $11.32 in 2018, up from $10.09 in 2017. In Point Roberts, the average house value of $239,600 would generate property taxes of $2,736 in 2018, versus $2,418 in 2017. The mill rate is $11.42 in 2018, up from $10.09 in 2017.

In Blaine, the average house value of $264,800 would generate property taxes of $2,997 in 2018, versus $2,672 in 2017. The mill rate is $11.32 in 2018, up from $10.09 in 2017. In Point Roberts, the average house value of $239,600 would generate property taxes of $2,736 in 2018, versus $2,418 in 2017. The mill rate is $11.42 in 2018, up from $10.09 in 2017.

Most of the increase in taxes comes from the hike in state education taxes which have increased 96 cents per $1,000 valuation (from $2.23 to $3.20). This follows the state legislature’s decision to hike the state education levy to comply with Washington State Supreme Court’s McCleary decision requiring the state to fully fund basic K-12 education.

Other taxing jurisdictions showing increases are the Blaine school district (up 30.6 cents from $2.496 to $2.8025 per $1,000 valuation) and the county flood control district (up from 12.9 to 16.5 cents).

The state legislature intends to claw back some of local school districts’ taxing authority next year but how much is still to be determined.

What is known, however, is that the Blaine school district is putting forward a capital works levy on an April special election ballot, just around the time that people will be hunkering down to pay their property taxes.

While the tax won’t come into effect until 2019, taxpayers will be asked to pay another 50 cents per $1,000 valuation to pay for a long shopping list of items such as building a new grandstand, purchasing property in Birch Bay for a future school and upgrading parking lots.

Unlike a capital bond which requires a supermajority of 60 percent approval, a levy merely requires 50 percent approval by voters. It remains to be seen how anxious taxpayers will be to approve another tax increase.

Comments

No comments on this item Please log in to comment by clicking here